People

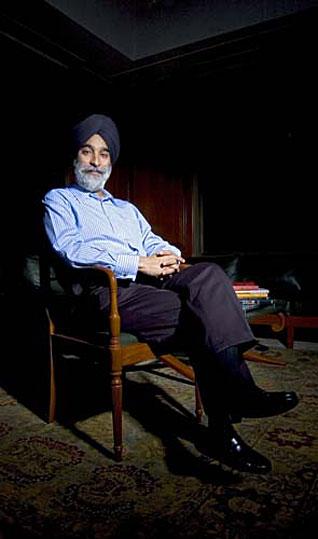

Bhai Analjit Singh:

He Dares to Dream Big

by MOINAK MITRA

Bhai Analjit Singh is restless for change, as he has been all through the years.

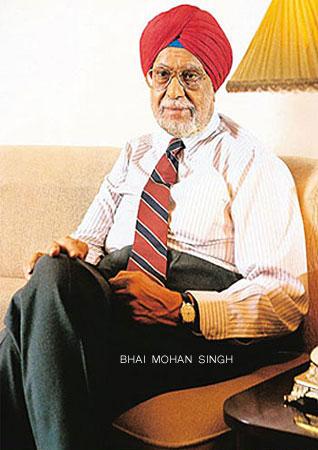

Only this time, it's for the greater good. And with consultant Ram Charan assisting him along the way, there's no looking back for the youngest son of Ranbaxy founder, Bhai Mohan Singh.

An out-and-out family man, Analjit Singh founded his life insurance and healthcare group in the wake of the new millennium by naming the Rs 4,891 crore conglomerate Max India .

Now if MAX sounds hip, this is what Analjit had in mind while naming his company: the "M" in Max stands for his father, Bhai Mohan Singh; the "A" for his mother, Sardarni Avtar Kaur; and, interestingly, "X" for everybody else. Today, it's the X-factor Analjit Singh is chasing.

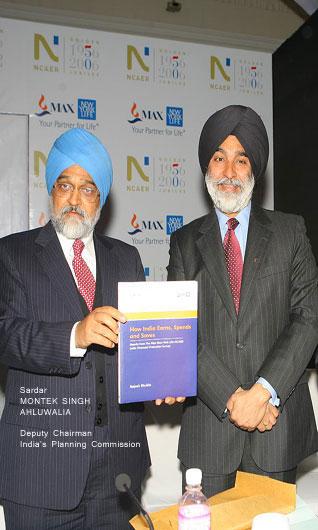

"Three months ago, Dr Ram Charan gave me homework in New York. He wanted to know three things: what I was doing to make my businesses sustainable; what I was doing to remove its dependence on me; and what I was doing to perpetuate the legacy of what I was trying to build at Max. I'm arduously going about addressing all those questions," says the nattily-attired Sikh, throwing the gates of governance wide open at his publicly-listed group companies - Max New York Life and Max Healthcare.

Restlessness casts its shadow on the 54-year-old Analjit Singh, as he faces the camera to talk me, or doles out pearls of wisdom along with his consultant, Ram Charan. The duo have to catch a flight to New York the morning after, and the conversation that ensues is peppered with fast cuts and glitch-free flow.

In the past, all his forays - penicillin raw material, formulations, bulk drugs, BOPP films, radio paging, cellular services, IT, clinical research, healthcare and life insurance - have been greenfield ventures born out of this restlessness. And the B-School grad from Boston knows time is running out for him to achieve his dream, which is to bring service excellence to India Inc.

When Analjit Singh sold his stake in Hutchison Max for Rs 650 crore, he was straddled with cash with no clue of its re-investment. That's when a McKinsey advisor told him to write his obituary . He got the message and strove for service excellence, foraying into healthcare and insurance. Today, he's striving even more to ensure his companies remain professionally-managed, while loosening the 33.3% promoter's holding of Max India, with Ram Charan as his torch-bearer .

On his part, Ram Charan is categorical on board supremacy. "The CEOs will come and go, the boards won't . If you have the wrong board, it's self-defeating for any company. The families in India must understand this. If your company is going public, the board is more important than the CEO, no matter how rich you are," he says, with his one-time B-school student Analjit Singh nodding in full agreement.

He picks up the thread claiming how he's making room for succession at Max by removing himself from day-to-day operations. "I've appointed Anuroop (Tony) Singh as vice-chairman of Max India, and five others, including Dr. Ram Charan, to the board of Max India. He (Ram Charan) has left me with some mantras for good succession at the managerial, professional and even at the family level," says Analjit Singh.

On that note, Singh dissects the two-day strategy session Ram Charan conducted for the 40 top people of Max India, wherein the consultant emphasised the importance of discipline, values, leadership, avoiding excesses and thereby, building trust.

After all, in a slowdown , a face-to-face with the author of Leadership In The Era Of Economic Uncertainty can only make things better. "Leaders don't feel victimised , they focus on the realities, inspire people and then prepare to go through the fog and become better," says Ram Charan.

"Good leaders try and understand the root causes of the downturn, because it is a different kind of downturn than before. Secondly, nothing is more important than people and it is time to protect your people. Three, while you have to survive for the short-term, you must build for the future."

At this juncture, Analjit flits back to his training session with Ram Charan and reflects on how his advice on making careful choices has helped. In the recession, while big names in insurance, like AIG, have fallen, it doesn't bother Analjit.

"I'm very fortunate because we picked a partner like New York Life, which is a mutual company, as against a stock or public company and life insurance is what they've done for over 162 years. As a matter of fact, they not only didn't just get into structured products, mortgage markets, derivatives and housing loans, but that is one life insurance company whose ratings have gone up in the last six months."

In the same vein, Analjit tied up with the Bupa Group in health insurance almost two years ago, a pure-play health insurance and life care company for over 100 years. His focus is unflagging when he's asked if his group is looking to go global.

"The reinvented Max is 8.5 years old and has moved from kalyug to "focus yug." We've knocked up over a billion dollars in sales and about 3.8 million customers, but I still say we are a young company and consider India as a continent, not a country, and the National Capital Region (NCR) as a country, not a city.

"So I think there's a lot to be done in insurance and our strategy for life and health insurance has been pan-national. I plan to do the same in healthcare, even in a narrower geography (NCR). I cannot deliver more focus outside my backyard," says Analjit Singh.

Getting back to the boardroom, Ram Charan does not wholly blame boards for the upheaval in the markets.

"The key to the recession is the breakdown on the financial side. Here, it is not just the greed, not just the overall compensation system, but the concentration of risk that has been overlooked by a number of regulatory agencies." That said, he goes on to talk about how directors in the U.S. are becoming more proactive and how the compensation systems are changing.

"I serve on five prestigious boards and see a discernible difference since October - the attendance of directors has become 100% and nobody's asleep."

"The duration of board meetings is getting longer and clearly the message is out there," seconds Analjit Singh. Ram Charan goes further to posit a case in point.

"The board of IT major Cognizant even goes a step further by inviting its customers for four hours, which goes on to show how keen they are on customer feedback," says the management expert.

Analjit Singh, on his part, may not have ventured that far yet, but has toyed with mystery shopping. He echoes Ram Charan's concern by amplifying the importance of customer insights.

"I personally attend to every single customer feedback that I get. In my business, we are talking about life and money and that's why the emphasis lies in trust.

"One of the best strategies to achieve higher levels of quality, service delivery and service excellence is to establish trust. Unlike other businesses, we don't have the opportunity to reverse a transaction. If you don't like the food, you can change the dish, but if I haven't serviced a claim in the case of a death, I can't take the money away.

"Therefore, to get the best-in-class and evolve to the next-in-class practices and for the renewal of professionals at a personal and functional level, we need somebody who embraces best global practices, and who is outside the forest, to come and talk to us," says Analjit Singh, as Ram Charan prepares to delve into how the forest looks from the outside.

"The key here is to keep your company aligned with the speed and nature of changes externally. Second, is to keep your culture aligned with strong values, but adapting to change. Look forward, not at the rear-view mirror," he advises.

That's exactly what Analjit has been trying to follow to the tee. "When you are in businesses that have an important social thread, like life insurance or healthcare, you cannot build trust if you're greedy. You can only be reasonably profitable and nobody denies you that, particularly in a country with wafer-thin margins. In no way can I slip something in," he says.

Ram Charan firmly believes that at any given stage, companies have to adapt to change. So for him, there's no American or Japanese or even Indian style of management.

"Take, for instance, Chrysler. A gentleman from Italy will be running it almost dictatorially, with fast decision-making using domain knowledge - shrinking it, selecting it, making it happen. The Italian style, if you will, fits this phase," he says.

In all earnestness, the management consultant now wants Indian business leaders to ponder on one question: Am I really growing? "Obsolescence is a terrible thing and all leaders should say if their capability is 'X' today, what should it be 3-4 years from now?," he asks.

Analjit Singh, perhaps, knows the answer.

As he paves the way for the X-factor in Max to bloom, he's nonchalantly scripting an ode to democracy - by the people, for the people, of the people - the very core of corporate governance.

[Courtesy: The Economic Times]

July 24, 2009

Conversation about this article

1: Bikramjit Singh (Delhi, India), July 31, 2009, 7:37 AM.

Bhai Analjit Singh ji, would it be possible for you to get actively involved in community welfare by coming on board of the S.G.P.C or the D.S.G.M.C? It would be an excellant business opportunity and public service if you become a founder of a top-class school or chain of schools in Delhi or the NCR. In addition, it would be great if you can open a medical college or university as it will be inline with your present business. This will make sure that your family's legacy continues for generations to come.

2: Ramandeep Singh (New Delhi, India ), August 08, 2009, 5:47 AM.

I wish I could become your personal assistant and learn from you ... but, unfortunately, my English skills are not of your level, Sir.

3: K.V.N. Sharma (India), February 23, 2011, 6:20 AM.

In my professional career so far, I still cherish my memories and feel proud to have been associated with Max India. I would like to narrate my experience while I was deputed along with three other members to Hutchison Max at Bombay sometime in 1994-95 for facilitating the telecom arm of Max to acquire terrace rights in Bombay and to attend legal issues arising therefrom. Bhai Analjit Singh would review the progress personally at periodical intervals and always patted us on the back as we were able to maintain the timelines. All the group members were awarded, once the commercial launch was successful. After a couple of years I left Max. I met Bhai Analjit Singh at Mumbai Airport by chance while I was waiting for a security check. He affectionately greeted me and hugged me. Whenever I recall this experience, I honestly feel great. Their family is full of sanskars the society craves now-a-days.

4: Praveen Khilnani (Delhi, India), July 08, 2011, 7:23 PM.

I remember my contact with Bhai Analjit Singh when we started interacting at the inauguration paatth of MAX Super speciality Hospital in Saket (Delhi, India) in 2006. I had recently been featured in a CBS TV show (60 Minutes) in 2005 with Bob Simon on health care tourism in India as a doctor from the U.S. who had returned to India and delivered care to many foreign patients at one eighth of the cost of what it would cost in the U.S. My suggestion to Bhai Analjit singh was to look into that aspect. He sounded surprised and said: "I don't think someone who wakes up in Frankfurt would want to come to India for medical treatment," but he sure followed up on the matter. And look where health care tourism is today ... and still growing.